In Washington State, Seattle restaurant owners are facing the minimum wage increase that came into effect on April 1st. Just because you are in another city or state, don't think you're safe. The increased minimum wage law will spread outside Seattle and Washington. New York already has a law in the planning stages.

Restaurants are attempting clever approaches that will allow them to stay in business with the increased labor costs. One of those methods is replacing tips with a service charge.

According to Washington State law, service charges are different than tips because they are compulsory; customers do not have a choice whether or not to pay them.

According to the IRS, service charges are considered wages and the property of the business, "Generally service charges are reported as non-tip wages paid to the employee. Some employers keep a portion of the service charges. Only the amounts distributed to employees are non-tip wages." For reporting purposes the IRS states, "Employers who distribute service charges to employees should treat them the same as regular wages for tax withholding and filing requirements.."

The Service Charge Must Be Clear to the Guest

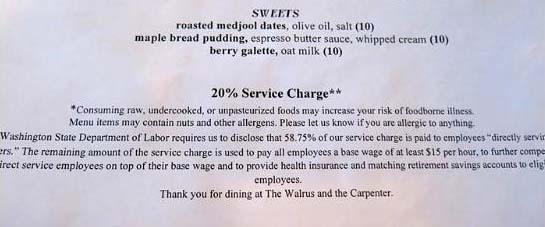

In Washington, there are disclosure requirements, "An employer that imposes and automatic service charge related to food, beverages, entertainment, or porterage provided to a customer must disclose in an itemized receipt and in any menu provided to the customer the percentage of the automatic service charge that is paid or is payable directly to the employee or employees serving the customer." Some cities require 100% of the service charge be distributed to the employees involved in the act of service. Seattle allows collection and redistribution of service charges.

The receipt needs to say exactly what the percentage is, and where it is going. Is it 20 percent to the server? Is it 20 percent to front-of-house employees? Is it 20 percent distributed among front-of-house and back-of-house employees? Whatever the arrangement is, it needs to be spelled out with percentages.

Service Charges Increase the Cost of Doing Business

Service charges will not defray a higher labor cost. That is inevitable. Labor costs will increase and so will the taxes paid on increased wages. Under a service charge model, the amount distributed to employees will be recognized as wages, reported on paychecks and subject overtime calculations. Tips are not considered wages. Of greater concern is the lost of the 45B FICA tip credit. This is a dollar for dollar credit taken against the income tax due by the business owner of the pass-through entity.

Under a service charge, the FICA tax amount paid will be a deduction rather than a credit. It's not a complete loss, but if the business is making money, this is an unwelcome increase in taxes. Other less obvious increases will be expenses based on sales such as B&O tax and percentage rent so be sure to notify landlords and amend leases and specifically call out service charges. The guest will also pay more and service charges are subject to sales tax.

Employees Need to be Able to Communicate the Charges

Employees need to understand in detail the hourly increase or decrease in pay an additional benefits or drawbacks. If a workgroup is going to take a cut in pay, make sure it knows what it's for, and offer to increase the number of hours ordinarily worked for part-time employees which may result in a reduction in the number of employees. Most important is the communication to the guest. Service charges represent a change for consumers. Crafting a careful message that has complete buy-in from the staff to be communicated to the guest has to be clear and consistent. Lastly, speaking to the media must be handled at the top of the organization with no exceptions. The message to the media should reflect the same message to the employees and the guests.

Reference

For more information, please reference the Seattle Minimum Wage Ordinance Legal Review and Guide, provided by the Washington Restaurant Association and Washington Lodging Association as a service to members to help understand the Seattle Minimum Wage Ordinance and how to comply with it.